Mike Pazera, CFP ®

PAZERA CAPITAL MANAGEMENT, INC.

Joe Eckelkamp, CPA

OLIVER THORNBURG CPAS

In philanthropy, donating appreciated securities—such as stocks, bonds, and mutual funds that have increased in value since their purchase—has become an increasingly popular method for supporting charitable causes. This approach offers a compelling alternative to traditional cash donations for high-networth individuals looking to maximize their philanthropic impact and financial benefits. In this article, we’ll explore how donating appreciated securities works, why it’s beneficial, when it makes sense to consider this method, potential risks, and critical considerations.

How Donating Appreciated Securities Works:

Donating appreciated securities is straightforward yet requires careful coordination with f inancial advisors and the recipient organization. Typically, the donor transfers ownership of stocks, bonds, or mutual funds directly to the charity, non-profit, donor-advised fund, or foundation. These securities must be held for over a year to qualify for the most favorable tax treatment.

Upon receipt, the charitable organization can either hold onto the asset and let it appreciate further or sell it. The charity does not pay capital gains tax on the sale, which means the full value of the donated asset goes toward supporting its cause.

Why and When Donating Appreciated Securities Makes Sense:

- Tax Advantages: The tax benefit is the primary incentive for donating appreciated securities. Donors can deduct the total fair market value of the security at the time of donation, not just the amount originally paid. Moreover, they avoid paying capital gains tax on any appreciation, which can be substantial.

- Market Timing: This method is particularly advantageous during periods of significant market gains when investors may have substantial unrealized gains. It also makes sense when adjusting investment portfolios for strategic rebalancing. The donor can use the cash they would have donated to invest in their portfolio and rebalance risks. [Many times, unrealized capital gains and the potential tax liability a sale would create hinder this ability.]

- Philanthropic Goals: For those with a strong desire to give back, transferring appreciated securities can increase the magnitude of their donations. This method allows donors to leverage market appreciation to make a more substantial philanthropic impact.

Benefits of Donating Appreciated Securities:

- TAX EFFICIENCY: Maximizes the value of the charitable deduction on personal income taxes.

- INCREASED CONTRIBUTION SIZE: Enables larger donations since the cost basis is lower than the current market value.

- REDUCED CAPITAL GAINS: Avoids capital gains taxes on any increase in the value of the donated securities, which can be significant.

- SIMPLICITY: It is easier to transfer shares electronically than to sell them and donate cash.

Considerations & Potential Risks

While donating appreciated securities offers numerous benefits, it also involves some other considerations and risks:

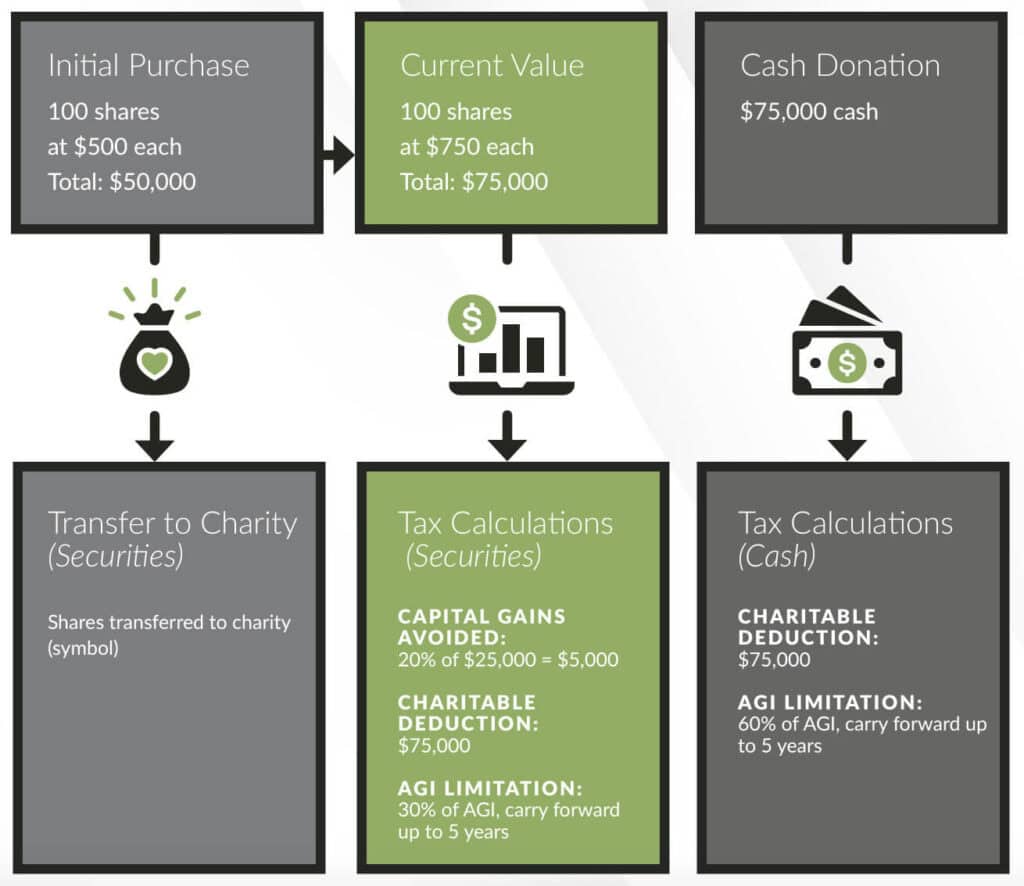

- AGI LIMITATIONS: Adjusted gross income (AGI) limitations that apply to gifting appreciated securities. Generally, the deduction is limited to 30% of the donor’s AGI for the year the gift is made. Any excess can typically be carried forward and used in tax returns for up to five subsequent years. (cash donations are typically limited to 60% of AGI)

- LIQUIDITY RISK: Charities might need to sell donated securities at less-than-ideal times, potentially affecting their financial strategies.

- MARKET VOLATILITY: Securities can depreciate in value before being liquidated by the charity, reducing the potential benefit to the organization.

- COMPLEXITY IN VALUATION: Certain types of securities, like closely held or restricted stocks, may be challenging to value or transfer.

EXAMPLE:

To illustrate, let’s assume a donor purchased 100 shares of a stock at $500 per share, totaling $50,000. Over time, these shares appreciated to $1,000 per share, bringing their current market value to $100,000. By choosing to donate all 100 shares directly to a charity, the donor avoids potential capital gains taxes on the $50,000 increase in value. Assuming a capital gains tax rate of 15%, this would amount to $7,500 in tax savings. However, it’s important to note that for higher-income individuals, the capital gains tax rate can be as high as 20%, plus a potential additional 3.8% net investment income tax.

In such cases, the tax savings would be even more significant, enhancing the financial benefit of donating appreciated securities. Additionally, the donor can claim a charitable deduction of $100,000 on their tax return. This scenario underscores the considerable advantages of donating appreciated securities, both in supporting the chosen charity and in optimizing the donor’s tax situation.

Conclusion

Donating appreciated securities is a powerful tool for high-net-worth individuals to fulfill their philanthropic ambitions while optimizing tax benefits and financial outcomes. It’s essential to consult with a wealth manager and tax advisor to navigate the complexities of this giving method effectively. With careful planning and strategic execution, donating appreciated securities can be a win-win for both donors and charitable organizations, magnifying the impact of philanthropic efforts and fostering positive change in the community.

Please don’t hesitate to reach out for a complementary second opinion on your gifting strategy.

Mike Pazera, CFP ®

PRESIDENT

[email protected]

A graduate of Baylor University, Mike has more than 17 years of professional experience in the finance industry. He enjoys working with family-centric executives & entrepreneurs looking to create lasting legacies by helping them navigate the unique challenges success, wealth, and family entails. Mike and his family reside in Southlake, TX.

Joe Eckelkamp, CPA

OLIVER THORNBURG CPAS

[email protected]

A graduate of Texas Tech University, Joe has been working in public accounting for over 7 years. During his time, he has served many high-net-worth individuals, entrepreneurs, and small business owners. From getting things started to helping wind them down, Joe enjoys working with his clients through all stages of business and life.

ACKNOWLEDGMENT: This article was written by Mike Pazera, CFP®, and Joe Eckelkamp CPA, and is distributed with both parties’ permission.

This report is intended for educational purposes only and does not constitute a solicitation to purchase any security or advisory services. Past performance is no guarantee of future results. An investment in any security involves significant risks, and any investment may lose value. Refer to all risk disclosures related to each security product carefully before investing. Securities are offered through Geneos Wealth Management, Inc., Member FINRA / SIPC Pazera Capital Management, Inc., a registered investment advisor.